how to find investors for my business

It's a fact. Well-nigh 90 pct of startups fail, which means but 10 pct survive. There are many factors that volition transform your startup idea into the business you lot've always envisioned. Yous need a fantastic thought that is unique in your specific industry, non to mention investors for your startup. You demand a business AND marketing program. And, nigh importantly – yous need noesis on how to heighten upper-case letter and detect investors.

Detect investors.

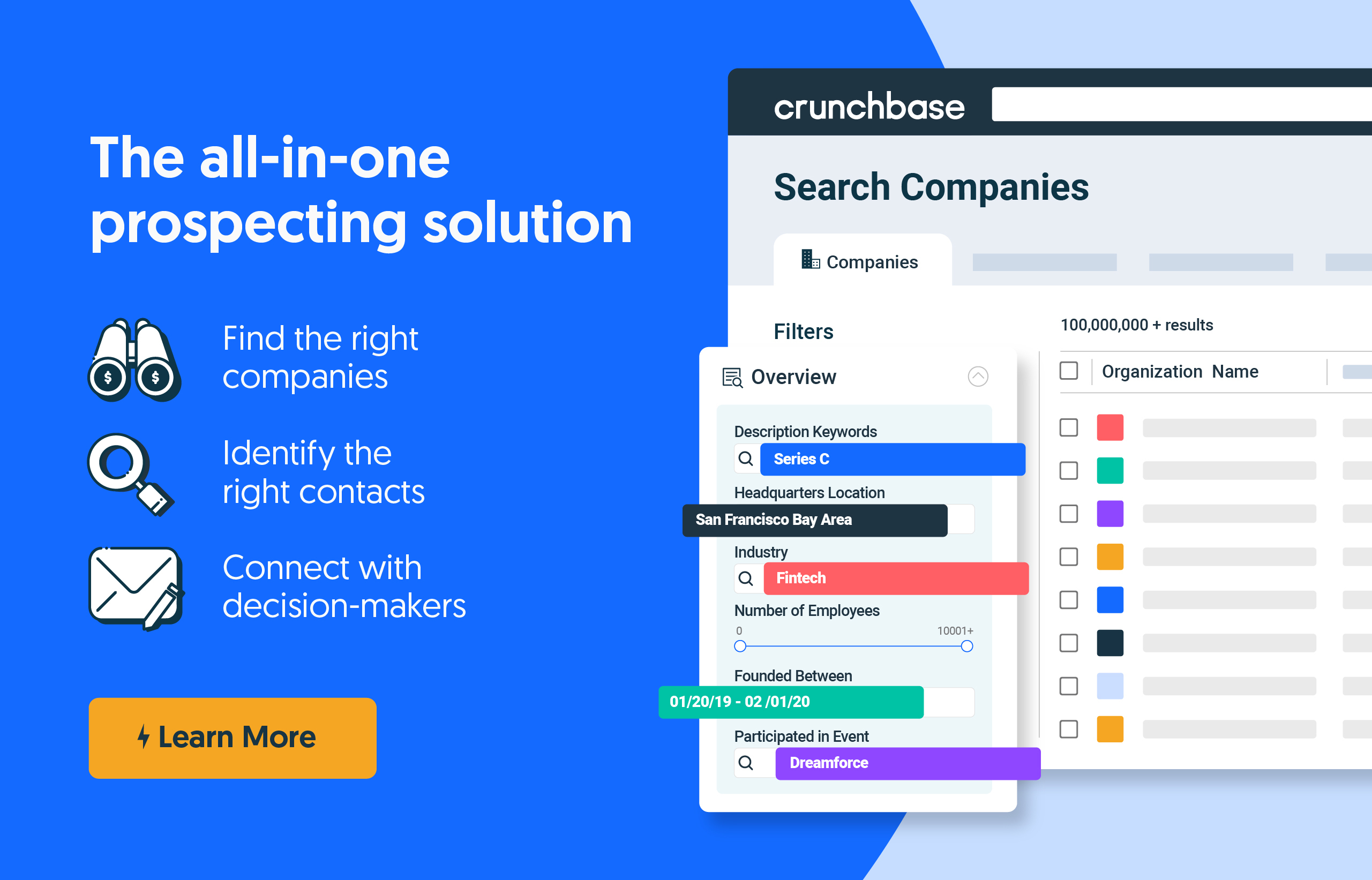

Find your adjacent investor with Crunchbase, the all-in-one business prospecting solution.

Whether you're crowdfunding or leaning toward the private investment market place, choosing the correct startup investors can make or intermission your visitor. In this article, you lot'll larn everything you need to know well-nigh how to discover investors for a startup, including:

- The different types of investors past company stage

- Where and how to notice investors for a startup

- How to ready your pitch

- How to know what you lot want from an investor

- How Crunchbase tin can assist yous find investors for a startup

The different types of investors past visitor stage

In that location are a variety of investment opportunities for you lot to consider when trying to acquire funding for your startup. Depending on where your business is at in its development, some funding options may brand more sense than others.

When finding investors for your business, your company should seek to mix-and-match investment opportunities throughout the diverse stages to ensure that you have multiple, diverse uppercase streams. Here'due south a deeper await at some typical private investment options based on company development stage equally you get started:

Thought Stage

All startups brainstorm with an idea (or ideas). In this phase, the entrepreneur is still developing and fine-tuning the concept of the startup and needs funds to complete essential tasks such as creating a detailed business plan (they probably don't even have a website still). Funds in this early stage are typically raised through personal finances or close connections.

Bootstrapping

You are the investor. At the Idea Stage, information technology can be hard for companies to go about raising funds and finding business investors, so in many cases, information technology falls to the founder to provide the initial startup uppercase. While it's of import to understand that investing your ain coin can be risky, information technology also allows for consummate command of the business void of any outside influence or conflicting visions. Bootstrapping is a bang-up choice for building small businesses.

Funding a startup with personal finances in the Idea Stage is also a way to safeguard yourself from debt should the venture non succeed (or doesn't launch in the first place). Equally the business grows, however, information technology is probable that you volition not be able to sustain it with your own money, and will eventually need to bring in outside investors to admission additional financing.

Friends and Family

Most entrepreneurs receive substantial financial help from friends and family in the Idea Stage. These tend to exist the truthful believers in your project or those who are closest to you and want to assist make you successful. While 'investors' that are members of your close customs tend to be easy to handle when you lot're starting out (frequently because they are less involved in solar day-to-day operations), accepting coin from those closest to y'all can bring about personal tension and stress. Friends and family may not follow upward or be checking regularly for a return on their investment, simply they exist volition anxious to become their money dorsum (and then some) as the visitor grows.

Pre-Seed Stage

In this phase, the entrepreneur needs additional funds to sustain current growth and to perform tasks similar marketplace validation. An entrepreneur tin go on to rely on funding options from the Idea Phase in addition to exploring some new external avenues besides.

Pre-Seed is even so a relatively new miracle in capital fundraising that has come about as a response to investors dedicating less money to new ventures in the Seed Stage. Entrepreneurs are continuing to refine their approach to funding in this stage every bit it isn't quite as established – new lessons and all-time practices are being discovered regularly.

Crowdfunding

The not bad affair about crowdfunding to detect business investors is that it opens up the opportunity for investment to literally anybody. By using social media (Facebook/Meta, LinkedIn) and sites such as Kickstarter , GoFundMe and Indiegogo , yous can pitch your business idea or product and connect with people around the world who tin donate coin – all without having to cede any equity in your company.

Crowdfunding is a easily-off approach to investment when information technology comes to impacting your bodily mean solar day-to-twenty-four hours business organization operations. While crowdfunding may seem similar a grassroots approach, many startups accept received millions in donations from these sources.

Incubators / Accelerators

Businesses in the Pre-Seed Stage that testify significant promise can use to incubators or accelerators to receive a number of benefits. In well-nigh cases, if your company is invited to participate in 1 of these programs, you can look a land-of-the-art work environment, business organisation mentorship, strong industry connections, and for the almost promising ventures, seed funding.

Being accepted into a startup incubator or accelerator is very hard as in that location is a significant amount of competition. Additionally, receiving funds is not a guarantee as many of these programs are designed to assistance founders and entrepreneurs grow their businesses by providing mentorship and resource other than money.

Angel Investment

Startup angel investors are function of the individual sector. Even so, angel investors are unremarkably individuals rather than private firms, so investments tend to be smaller – retrieve $25,000 to $100,000.

These players invest in you with the expectation of a high return on investment (ROI) and may cull to play a larger part in the management of your startup by requesting input on daily operations. Angel investors may also ask for a seat on your board of directors. Many startups find angel investors on sites like Crunchbase or AngelList.

Seed Stage

The Seed Phase marks the point in a visitor's growth where all of the initial preparation comes to fruition and the business begins to acquire customers. For an entrepreneur, the challenge in this stage is to carve out a market share and to find a mode to ensure repeated success.

At this phase, a Series A funding round to raise anywhere between $1M – $30M will need to take place, which typically leads an entrepreneur abroad from a check from individual investors and toward investment firms.

Venture Capitalists (VCs)

These investors are role of the private sector and have a puddle of money to depict from corporations, foundations, alimony funds, and organizations. Investments in businesses that are rapidly expanding or take the potential for substantial growth tin can boilerplate $7 million depending on a number of factors. Venture capital investments are more common for applied science and biomedical companies.

These firms will play a more active function in your startup, as they will receive some equity in exchange for funding, and volition assistance provide expertise in guiding yous throughout your development stages. VCs for startups tin be utilized in the early or late stages of development as some specialize in working with companies in the Seed Stage whereas others may prefer to work with more established businesses.

Venture majuscule is always-irresolute and requires significant enquiry prior to coming to terms with VC investors on a funding round for your startup. Information technology's a good thought to lean heavily on professional person communication and counsel from legal and finance teams while meeting with interested investors.

Venture Debt

This blazon of funding is only available to those entrepreneurs whose company is already venture-backed. Venture debt funding is essentially a loan that you volition have to repay, regardless of if the company is profitable, without having to give upwards whatever equity.

Repayment terms tin can vary, but three years is the average. Venture debt is a great tool for short-term financing, especially for companies who demand to make a one-time purchase and simply don't have enough capital on-hand at the time, such as a retailer re-stocking for their peak season. Entering into a venture debt agreement should non be taken lightly. Missing a single repayment could forcefulness the company into being sold or liquidated due to unfavorable default terms that are typical of this funding selection.

SBA Microloans and Microlenders

If y'all're looking for a smaller investment, a microloan may exist your best choice. The Minor Concern Administration (SBA), a government entity, offers a programme that connects startups to private lenders for loans of upward to $50,000. Other microlending nonprofits are also bachelor and can offer loans averaging $12,000 to $13,000.

Microloans are ideal for startups – think flower subscription companies and independent bakeries – that are only in the beginning stages of building out their services and are in need of seed money. As far as how much input these investors may accept, information technology can vary on a example-by-case ground. If you lot're wanting total control of your concern, exist sure to clearly state your desired relationship and outline specific guidelines in the loan agreement.

Early Stage

In the Early Phase, entrepreneurs have established a sustainable sales model that has proven to provide the company with a consistent influx of revenue. Now, an entrepreneur must consider scaling the concern to keep upwardly with product or service demand.

To raise plenty majuscule at this stage, an entrepreneur will brainstorm a Series B funding round with larger, later-phase venture capitalists, super angel investors, or revenue-based financing options. Like a Series A funding round, a Series B ranges from $1M – $30M.

Super Affections Investor for Startups

These startup investors can be seen as a hybrid between a regular angel investor and a venture capitalist. Super angels deal in larger sums of coin, like a venture capitalist, ranging from $250,000 – $500,000 per investment, and look to partner with emerging "top" companies in their early developmental stages, similar to a traditional angel investor.

Where super angels differ from other angel investors is that investing in companies is their primary profession rather than information technology existence a side-stream of acquirement. Super angels are known as series investors are ever looking for new, profitable opportunities to invest their funds. It is not uncommon for several super angels to pool resources and plant an investment group .

Revenue-Based Financing

This type of funding is a expert pick for companies in the Early Stage that have demonstrated the power to bulldoze consistent acquirement with loftier gross margins. With this model, a business receives upfront capital in substitution for giving upward a fixed percentage of future acquirement to the investor every calendar month until the loan has been repaid in full.

For entrepreneurs who exercise not want to further dilute the equity of their company, revenue-based financing allows them to obtain money without losing any control. Because repayments occur on a monthly ground; however, y'all may notice that y'all have less capital in-hand each calendar month as a effect of this agreement.

Growth Stage

The Growth Stage signifies that a visitor has accomplished and surpassed several startup milestones. It means they are looking to scale at an even greater rate by calculation infrastructure and expanding operations.

For an entrepreneur in this stage, funding options can become more diverse equally individual equity firms and banks. Generally, private equity firms and banks are more take a chance-averse in the early stages. They look to invest in a proven entity. This circular of funding is categorized as a Series C, which seeks $10M+ in the capital.

Private Equity

Part of the individual sector, private disinterestedness firms invest in startups or businesses through shares or buying in the company. A individual disinterestedness firm unremarkably raises funds for investments through large tertiary-party investors such as universities, charities, pension plans or insurance companies.

Startup individual disinterestedness investors take a public company and make it private. This then results in 100 percent ownership of your business' profits.

Essentially, a private equity business firm has the capability to buy out your visitor.

Bank Loans

Traditional bank loans can be a valuable financing option if yous are able to secure favorable terms. Banks typically provide business organization startup loans with the everyman involvement rates and will not be given disinterestedness in the company.

Banking company loans do have an in-depth awarding process and require a potent credit rating. In extreme cases, a bank may mandate that you sign a personal guarantee on the loan. This means that they can recoup their losses from personal avails should in that location exist a default on the repayment.

There is no shortage of funding options and ways to make coin for your startup. Detailed research is required at every development stage. Ensure yous're making decisions based on your company's goals.

Where and how to observe investors for a startup

Based on your company stage, you might take a skillful sense of what kind of investment you should seek, but you're probably still thinking, "where can I detect investors for my business concern?" Information technology all boils down to one critical step: networking.

When y'all meet the right people, a wealth of opportunities can appear right before your eyes. If you're beginning to strategize how to get investors for a startup, be sure to talk and network with people in your industry. Nourish all the manufacture events possible, even if yous retrieve you're underqualified or if your business organisation doesn't yet exist. You lot may or may not notice investors, but you'll definitely accrue noesis from young man startup owners or business concern veterans. Try to create relationships that may benefit y'all in the hereafter – you never know when or where yous might find investors for a startup business.

Discover the right investors.

Identify the right investors for your business with Crunchbase.

Online resource such as Crunchbase Pro take valuable investor and business information and pair it with our extensive database then you can easily filter and review the data that is most relevant to your business organization. Using a company database tool takes the load off when conducting extensive research within your industry since information technology'south bachelor all in one platform, versus having to open up multiple tabs and platforms to fill in the gaps.

How to prepare your pitch

And so, you've got the nigh astonishing idea for a startup and you're thinking about how to detect investors for your minor business. Simply you don't accept concrete business and marketing plans? Chances are, no 1 will invest in a hypothetical business without solid market place inquiry – they know better. You need to show demonstrated need or demand. Lastly, investors for your startup must see a clear action programme to reach success with established operation milestones forth the way.

The fundamental to getting your startup to take off is specificity and long-term planning. Yous need to include exact amounts of how much you need in investments too as what you expect your ROI to be. You should know how many expenses yous'll take and details on your targeted consumers. And lastly, yous should take an idea of how to market your product/service and a vision of how you want your startup to grow.

You too need to exist highly knowledgeable in the field you are getting set to enter. Know who your competitors are, the history of your manufacture, and the present country of success in the field. Potential investors will ask yous questions during your presentation. You need to be able to thoughtfully and thoroughly answer them to have any chance at getting investors for your startup.

Overall, keep your sales pitch concise . Have some sort of PowerPoint or visual storyboard that'due south about 10 to xv slides maximum. Brand sure the content in your presentation tells a compelling story just is no longer than twenty minutes. Your presentation should serve as a guide only, so don't read it discussion for discussion. Call up that you lot must become an practiced.

Know what investors you want for your startup

Before you reach out to potential startup investors, know exactly what y'all want relationship-wise.

Perhaps you want a guide through the procedure of creating a business organization. In that case, venture capitalists, angel investors, or individual equity firms are probable more compatible with your startup funding. If your focus is purely to seek funding, you lot're more suited for things like microloans or crowdfunding.

Knowing how to observe an investor that is perfect for your business organization could bring your startup idea to life.

How Crunchbase can help yous find an investor for startups

Save time and find venture investors who see your exact needs with our Crunchbase Pro searches that help you sort by some of the about common filters like the exact amount of money you need, the location of an investor and your specific industry.

With Crunchbase Pro, you can eliminate the guesswork and be sure that you always get the best search results to meet your criteria. Yous can too view a potential partner'due south past investments all in one place. Fine-tune your search by adding layers of additional data with our trusted third-party apps. Then, create a list to get alerts when investors you're interested in brand new investments or are featured in the news. You can even observe electronic mail addresses and contact data that tin can help you connect with target investors, all inside Crunchbase.

Source: https://about.crunchbase.com/blog/investors-for-startup/

Posted by: beckempting2000.blogspot.com

0 Response to "how to find investors for my business"

Post a Comment